2025 marks the tenth year of CPM–Retail Safari’s Christmas Shopping Intentions Report, tracking how Australians approach Christmas gift shopping.

Across a decade of research, the data tells a clear story. Sales events like Black Friday now shape the season, omnichannel shopping has become the norm, and gift preferences are evolving toward more meaningful presents. The 2025 edition captures a retail landscape shaped by value, omnichannel behaviour and shifting gift priorities that define how Australians shop for Christmas.

Omnichannel dominates how Australians shop for Christmas gifts

Australians now take an omnichannel approach to Christmas gift shopping, moving seamlessly between digital and physical channels. In 2025, 89 per cent plan to buy both online and in-store, nearly double the share from 2016. Online offers convenience and reach, while stores remain valued for the ability to see and touch products before buying. Together, these behaviours define how Australians navigate the path to purchase during the festive season.

Cyber Weekend defines when Australians shop for Christmas

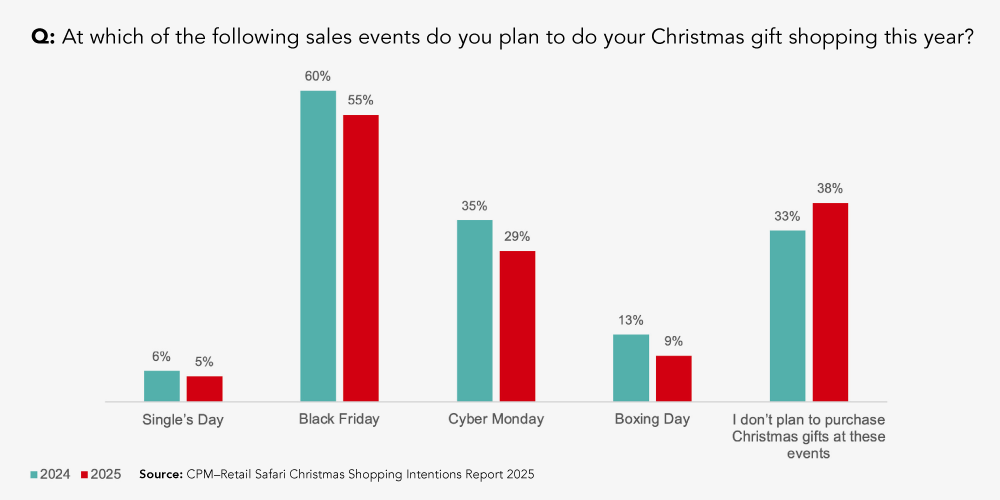

Black Friday and Cyber Monday have reshaped the Christmas shopping calendar. November is now the peak month for gift purchases, with 55 per cent of Australians planning to buy during Black Friday sales. Sales events are now central, with 62 per cent planning to buy Christmas gifts during them. Boxing Day, once the hallmark of post-Christmas discounts, has been overtaken.

Cyber Weekend is anchored online, with 83 per cent of Australians shopping digitally and 74 per cent buying electronics. For retailers, the imperative is clear, campaign planning and promotional activity must begin earlier to align with this new seasonal rhythm.

The data clearly shows how sales events have reshaped the Christmas shopping season, with Black Friday now well ahead of other major events.

Gift preferences are shifting from gift cards to thoughtful presents

Gift cards, long the easy option, have lost ground. In 2025 they rank fifth on Christmas shopping lists, behind clothing and shoes, books and experiences. Younger Australians are driving demand for leisure and entertainment gifts, signalling a move towards more personal and experience-based giving. This trend reflects a broader consumer desire for gifts that feel meaningful rather than transactional.

Stores remain central to the Christmas gift experience

Despite the rise of digital retail, physical stores remain essential to how Australians shop for Christmas gifts. In 2025, 41 per cent say they go in-store to see and touch products before purchasing. This tactile experience builds trust and confidence in buying decisions, especially when gifting. Stores continue to complement online channels by offering immediacy, human interaction and the reassurance of physically engaging with products before purchase.

Payment choices and emerging technologies

Cards are the top payment method for Christmas gifts in 2025, led by debit at 61 per cent. This year’s new findings also reveal early experimentation with AI-powered tools and social commerce, though these are not yet mainstream. These results suggest Australians are beginning to explore new ways of discovering and buying Christmas gifts.

What a decade of insights tells us about 2025

The 2025 Christmas Shopping Intentions Report highlights ten years of change in how Australians prepare for the season that defines retail. To win this Christmas, retailers must deliver value, make omnichannel seamless and understand the motivations shaping Australians’ gift choices. Retailers that move early and act decisively will capture the greatest share.